Be sure to like this post if you come to enjoy it, and subscribe if you aren’t already!

Too Much Diversification?

Many financial “experts” consider portfolio diversification the key to success. This intuitively makes sense—if you have 4 stocks and 1 goes down 50% it hurts more than if you have 20 stocks and 1 goes down 50%. On the flip side, an argument I never see made, if you have 4 stocks and 1 goes up 50% it benefits you much more than if you have 20 stocks and 1 goes up 50%. My goal today is to take the side of this second argument, one that argues that too much diversification is just as dangerous as too little diversification.

Thoughts from Warren Buffett

Diversification is protection against ignorance. It makes little sense if you know what you are doing.

This quote from Warren Buffett is simple, and often misunderstood (and misquoted). The average Joe investor isn’t going to spend the time researching company 10K’s, keep up with quarterly reports, and learn the ins and outs of their investments. This leads to them (hopefully) investing into a diversified index fund—S&P 500 funds such as VOO 0.00%↑—allowing them to meet the performance of the overall market.

On the other hand, if you are putting in the time to have deep knowledge of all your investments, why spread yourself thin? It is unlikely you will find 20+ high quality companies to invest in—and if you think you did, your analysis may be flawed. If you have expertise in a field, such as software, manufacturing, consumer products, etc, you will better understand the upside and downside risks of companies in that space, allowing you to make more educated investments about companies in that space. If you know what you’re doing it is unlikely you need a massive portfolio.

Diversification may preserve wealth, but concentration builds wealth.

For most investors the primary goal is to build wealth. This goes back to the original argument posed in the introduction—does an upward or downward move of 50% mean more in a portfolio of 4 or 20? The first rebuttal in this case is often “Well the risk of the 50% move down is too much for me!” Okay, but what about the move upward? Did the market also move lower as your stock fell 50%? If so, then it is likely your stock is trading at its beta to the S&P 500. If the stock falls 50% but the market is up 10% in the same time period then it is time to hit the drawing board. What risk did you miss? Why did this not work out? Is this move related to other moves in this stock’s sector? Also, take time to be an optimist when investing. Find opportunities where the upside potential is much greater than the downside potential. For example, META 0.00%↑ in November 2022 at less than $100.

Thoughts from Charlie Munger

The whole secret of investment is to find places where it’s safe and wise to non-diversify. It’s just that simple. Diversification is for the know-nothing investor; it’s not for the professional.

Turns out Warren’s buddy Charlie has the exact same thoughts on diversification. Why diversify if you know what you’re doing? Charlie Munger (outside of Berkshire Hathaway) owns 4 stocks: Alibaba, Bank of America, US Bancorp, and Wells Fargo. Do you think anyone ever tells him he isn’t diversified enough?

While diversification limits volatility in a portfolio, well, I’ll let Charlie take this one again:

If you can’t stomach 50% declines in your investment, you will get the mediocre returns you deserve

The Reality of Over-Diversification

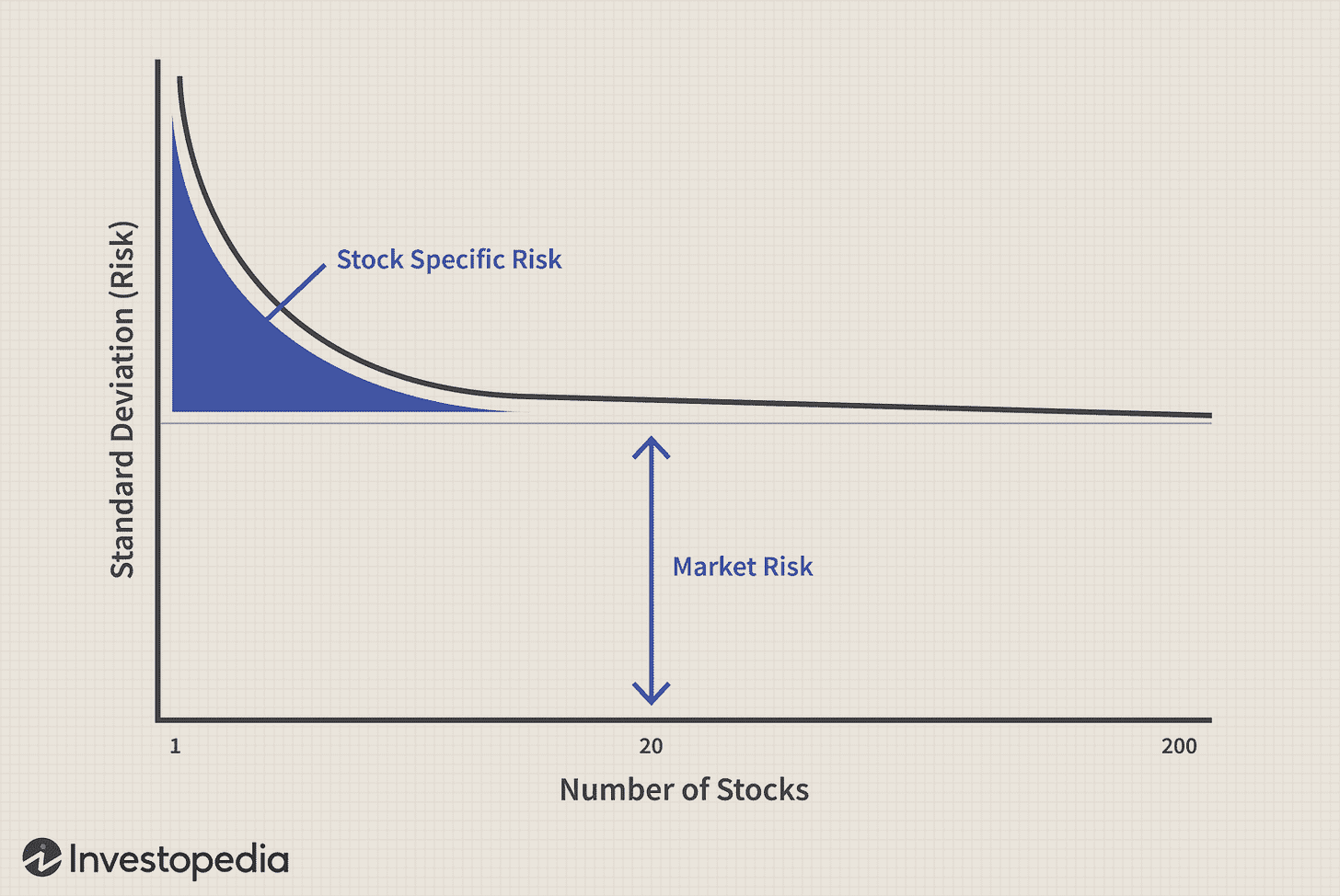

So how many stocks is too many? According to modern portfolio theory every stock past your 20th stock is not reducing risk in any significant way. In a book titled Modern Portfolio Theory and Investment Analysis, Edwin J. Elton and Martin J. Gruber found this to be true. Assuming standard deviation is understood as risk in this example, they found the average “risk” of a single stock portfolio to be 49.2%, while a well-balanced portfolio could have an average risk of 19.2%. They also found in a portfolio of 20 stocks, the “risk” was 22%. This meant that every stock added from 20 to 1000 only reduced the portfolio’s risk by 2.5%, while the first 20 stocks reduced the portfolio’s “risk” by 27%.

In simple terms, they found that holding any more than 20 stocks does not reduce portfolio risk in any substantive way. This is illustrated in the above chart, which shows the benefits to diversification fade after the 20th stock. This does not mean the optimal level of diversification is 20 stocks, as you can buy 20 stocks in the financial sector, and while you’d be diversified in that sector, you’d have zero diversification across the broader market. This just means the marginal benefit of risk reduction past the 20th stock (assuming the 20 stocks are across many sectors of the economy) decreases to the point where it is not optimal to continue diversifying.

What’s the Correct Number of Stocks to Own?

In reality, there is no right or wrong number of stocks to own. You can have successful returns owning 4 stocks, 10 stocks, 20 stocks, etc. It is just important to understand that you are not significantly reducing risk past the 20th stock in your portfolio. Too often do I see people believe having a massive portfolio means they are reducing risk. I find it hard to believe someone with a portfolio of 20+ stocks has the time for the proper research and up-keep needed to be a well-informed investor.

In true Buffett style, I try to be an expert on every single company I own. In my portfolio of 10 stocks (which used to be only 5) there is not a single one I would fail to describe the business of in full, my thesis, and the risks and opportunities facing that company. This is what you need to do as an investor who picks stocks. Of course this could all be avoided by buying the S&P 500 and never doing any research, but what fun is that?

Sources:

Quotes from Warren Buffet and Charlie Munger can be found in past Berkshire Hathaway investor meetings.

Beers, B. (2022, October 10). The dangers of over-diversifying your portfolio. Investopedia. https://www.investopedia.com/investing/dangers-over-diversifying-your-portfolio/

FROM MY LINKS POST TODAY: "Finally, a fund manager in a recent podcast made the interesting observation that if you create a basket (portfolio) of emerging or frontier markets, you generally end up with something that (in aggregate) is much less volatile than if you were to look at emerging markets at the index level. The fund manager explained:

"There are generally minimal trade flows between smaller emerging and frontier countries, so problems in the real estate market in Vietnam will tend to have no impact on the level of oil production in Argentina. The recent election in Thailand had no impact on the subsequent Greek election. Constitutional change in Chile won’t impact interest rate movements in Saudi Arabia.""

https://emergingmarketskeptic.substack.com/p/emerging-markets-week-june-26-2023