Conagra is Failing as They Continue to Raise Prices and Face Supply Chain Challenges.

Conagra Brands recent report is full of excuses for failed management.

Be sure to subscribe for free today to have every article post sent straight to your inbox! Articles are posted every Sunday and sometimes Tuesday.

Before We Start…

Conagra Brands CAG 0.00%↑ is a packaged snack food company that offers popular brands such as Slim Jim, Swiss Miss, Bird’s Eye, Reddi-Wip, and Chef Boyardee. It is important to note as you read this article that the most recent Consumer Price Index (CPI) Food inflation number came in at 9.5% when compared to February 2022. You’ll understand why this is important as you read this article. That being said, let’s take a look at Conagra’s most recent earnings report.

Conagra continues to raise prices to recover margins, claiming pressure from supply chains.

Organic sales growth is led higher by pricing, volumes get crushed in most recent quarter.

Mondelez has been a winner, while Conagra is failing its customers and investors.

Revenue, EPS, and Margins

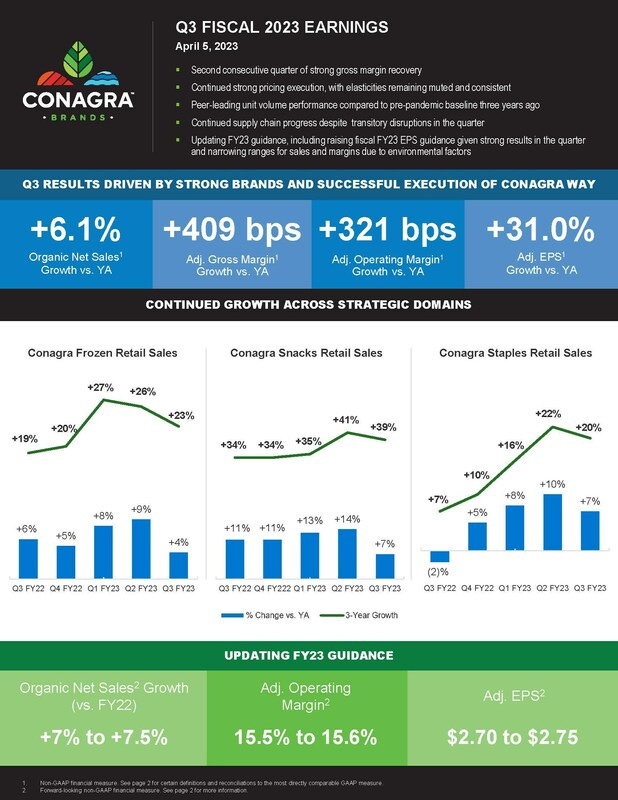

Conagra reported its fiscal year Q3 2023 earnings this past Wednesday, quarter ending February 28th. EPS came in at $0.76, beating Wall Street expectations of $0.64. Total revenue came in at $3.09 billion, beating expectations of $3.08 billion. Net sales increased 5.9% and organic set sales increased 6.1%. I will be coming back to this organic sales number in another section because it is rather significant under the hood.

Operating margin increased to 16.9% as the company continues to improve its margins after they took a hit as a result of supply chain disruptions from the pandemic. Conagra still sees supply chain disruptions, which is something else we will discuss, and projects full year operating margin of 15.55%.

A Look at Organic Net Sales

The 6.1% increase in organic net sales was driven by a 15.1% improvement in price/mix, which was partially offset by a 9.0% decrease in volume. Price/mix was driven by the company’s inflation-driven pricing actions. The volume decrease was primarily driven by the elasticity impact from inflation-driven pricing actions and supply chain, including manufacturing disruptions.

The above quote is pulled directly from Conagra’s earnings press release. When I read this I was absolutely blown away. I read a lot of earnings reports, especially in the “consumer packaged goods” segment, and have NOT seen this drastic of a price increase in any of them. Procter & Gamble, Kimberly-Clark, Colgate-Palmolive, and countless other companies have stopped pricing increases, some having stopped six months ago. This makes me wonder if management was late to increase prices in a significant way, or if they are taking advantage of the current environment.

I am not someone who believes companies raise prices at will, a basic microeconomics lesson will tell you this is hard to get away with, but I find it hard to believe that at a time where inflation has fallen every month since June that a company still finds it necessary to raise prices. At some point consumers are going to stop buying Conagra’s products and I would not want to be an owner of CAG 0.00%↑ at that point.

Supply Chain Disruptions… Still?

Here are a few quotes from the Conagra earnings call about their supply chain, I’ll let you digest them and then I’ll discus further:

“our supply chain is not yet fully normalized”

“While we're making good progress in supply chain, it's not back to normal and industry-wide challenges persist.”

“Supply chain is improving but it's not all the way back, and our position all year has been to plan conservatively in this regard”

So I think you get the point. Conagra’s earnings call was filled of talk about their supply chain disruptions, and investors ate it up, with the stock jumping over 3% after reporting earnings. As I mentioned before, I read a lot of earnings reports and calls, especially in the consumer packaged goods segment. If a company is still having supply chain issues, it is solely the fault of management. While this is anecdotal, I have not read an earnings call that talks about supply chain in about 6 months. This leads me to believe Conagra is behind the curve, they failed to fix these disruptions in a timely manner, and is worrisome.

Operating Segments Performance

Conagra reports earnings in four segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice. Grocery & Snacks accounted for $1.2 billion in sales in Q3, Refrigerated & Frozen came in at $1.3 billion, International checked in at $260 million, and Foodservice finished at $275 million. To save you time, every single segment saw organic net sales growth led higher by price increases, partially offset by volume declines. Foodservice saw the highest price increases at 18.5%, and Grocery & Snack’s volume decreased the most at 10%.

Final Thoughts

If you haven’t caught on by now, I am not a fan of Conagra Brands. It is not often I have a bearish take on The Simple Stock Report, with 3M MMM 0.00%↑ being the only one I can remember, but Conagra wins the honor of being number two. I believe Conagra is setting itself up for a huge decline in earnings. There will come a time when consumers are no longer willing to pay these high prices for snack food, and when they slow down these purchases (they already are if you look at volume), Conagra will suffer big time. Maybe this moment will never come and I am wrong about Conagra, but I don't think I am.

I think as a final word it would be important to compare Conagra Brands to another consumer packaged food company, Mondelez MDLZ 0.00%↑, makers of popular brands like Oreo and Chips Ahoy. In January 2023, Mondelez's CEO went on CNBC to discuss pricing at his company, stating they were not expecting to raise prices in 2023, as they felt their increases in 2022 were enough. On top of this, Mondelez has not experienced supply chain issues since the days coming out of the pandemic. Use that information as you will, but it seems to be Mondelez is doing business right and Conagra has failed their customers and shareholders.